Multiple Choice

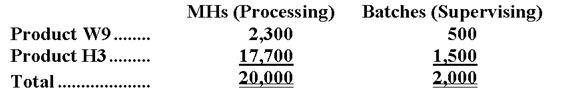

Sibble Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $12,400; Supervising, $4,400; and Other, $5,200. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

-The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

A) $1.33 per batch

B) $11.00 per batch

C) $1.00 per batch

D) $2.20 per batch

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Narayan Corporation has an activity-based costing system

Q15: Andujo Company allocates materials handling cost to

Q16: Roshannon Corporation uses activity-based costing to compute

Q17: Bossie Corporation uses an activity-based costing system

Q18: Traughber Corporation uses an activity based costing

Q20: Maccarone Corporation has provided the following data

Q21: Roshannon Corporation uses activity-based costing to compute

Q22: Ollivier Corporation has an activity-based costing system

Q23: Goold Corporation uses activity-based costing to

Q24: Pedroni Corporation uses activity-based costing to compute