Essay

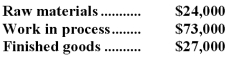

Alam Company is a manufacturing firm that uses job-order costing.At the beginning of the year,the company's inventory balances were as follows:  The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 45,000 machine-hours and incur $180,000 in manufacturing overhead cost.The following transactions were recorded for the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 45,000 machine-hours and incur $180,000 in manufacturing overhead cost.The following transactions were recorded for the year:

a.Raw materials were purchased,$416,000.

b.Raw materials were requisitioned for use in production,$420,000 ($380,000 direct and $40,000 indirect).

c.The following employee costs were incurred: direct labor,$414,000;indirect labor,$60,000;and administrative salaries,$212,000.

d.Selling costs,$141,000.

e.Factory utility costs,$20,000.

f.Depreciation for the year was $81,000 of which $73,000 is related to factory operations and $8,000 is related to selling,general,and administrative activities.

g.Manufacturing overhead was applied to jobs.The actual level of activity for the year was 48,000 machine-hours.

h.The cost of goods manufactured for the year was $1,004,000.

i.Sales for the year totaled $1,416,000 and the costs on the job cost sheets of the goods that were sold totaled $989,000.

j.The balance in the Manufacturing Overhead account was closed out to Cost of Goods Sold.

Required:

Prepare the appropriate journal entry for each of the items above (a.through j. ).You can assume that all transactions with employees,customers,and suppliers were conducted in cash.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: The use of predetermined overhead rates in

Q23: Sandler Corporation bases its predetermined overhead rate

Q24: Wert Corporation uses a predetermined overhead rate

Q25: At the beginning of the year,manufacturing overhead

Q26: Leija Manufacturing Company uses a job-order costing

Q28: During October,Crusan Corporation incurred $62,000 of direct

Q29: Snappy Company has a job-order costing system

Q30: Dobrinski Corporation bases its predetermined overhead rate

Q31: Period costs are expensed as incurred,rather than

Q32: Under a job-order cost system the Work