Multiple Choice

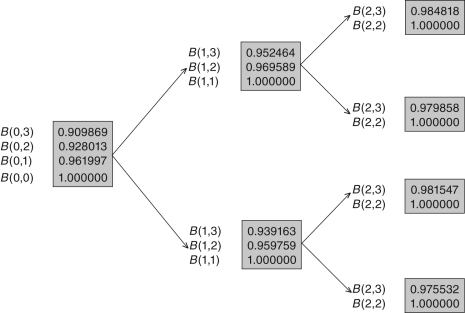

Use the fact that the pseudo-probability of default at time zero is (1 / 2) to answer the questions that follow.

-Consider a forward rate agreement (FRA) with maturity date 2.What is the FRA rate on this contract at time 0?

A) 0.019941

B) 0.036619

C) 0.039505

D) 0.019963

E) 0.017755

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A multiperiod binomial interest rate derivative pricing

Q2: A necessary and sufficient condition to

Q4: A multiperiod binomial model prices an interest

Q5: Use the fact that the pseudo-probability of

Q6: Which of the following statements about a

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4275/.jpg" alt=" -What is the

Q8: Use the fact that the pseudo-probability of

Q9: Which of the following statements about the

Q10: Use the fact that the pseudo-probability of

Q11: Use the fact that the pseudo-probability of