Multiple Choice

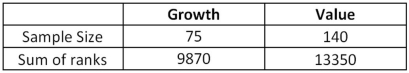

Exhibit 20.6.A fund manager wants to know if the annual rate of return is greater for growth stocks (1) than value stocks (2) .The fund manager collects data on the returns of growth and value funds.Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Refer to Exhibit 20.6.Since both sample sizes are at least 10,W can be assumed to follow a normal distribution with a mean and standard deviation of:

Refer to Exhibit 20.6.Since both sample sizes are at least 10,W can be assumed to follow a normal distribution with a mean and standard deviation of:

A) 434.74 and 8100

B) 8100 and 434.74

C) 8100 and 189000

D) 189000 and 8100

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Exhibit 20.11.A wine magazine wants to know

Q16: Exhibit 20.1.A pawn shop claims to sell

Q17: Exhibit 20.10.SHY (NYSEARCA: SHY)is a 1-3 year

Q18: The Wilcoxon signed-rank test for a population

Q19: Exhibit 20.12.A magician has a coin that

Q21: Let positive daily S&P 500 returns define

Q23: Exhibit 20.13.An energy analyst wants to test

Q24: Exhibit 20.6.A fund manager wants to know

Q25: Exhibit 20.9.A shipping company believes there is

Q86: For n<sub>i</sub> ≥ 5,the test statistic,H,for the