Multiple Choice

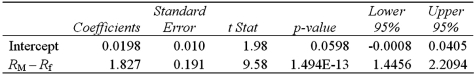

Exhibit 15-6.Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  Refer to Exhibit 15-6.You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses:

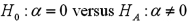

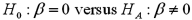

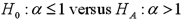

Refer to Exhibit 15-6.You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses:

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Exhibit 15-9.An economist estimates the following model:

Q15: Exhibit 15-5.The accompanying table shows the regression

Q16: Find the 95% confidence interval for the

Q17: A manager at a local bank analyzed

Q18: Given the following portion of regression results,which

Q21: Exhibit 15-1.An marketing analyst wants to examine

Q22: Serial correlation occurs when the error term

Q23: In regression,multicollinearity is considered problematic when two

Q24: A simple linear regression,<img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="A simple

Q49: Excel and virtually all other statistical packages