Multiple Choice

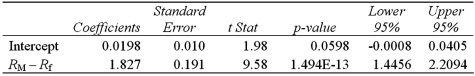

Exhibit 15-6.Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  Refer to Exhibit 15-6.When testing whether the beta coefficient is significantly greater than one,the value of the test statistic is

Refer to Exhibit 15-6.When testing whether the beta coefficient is significantly greater than one,the value of the test statistic is

A) -98.

B) 1.98.

C) 4.33.

D) 9.58.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Exhibit 15-1.An marketing analyst wants to examine

Q7: The accompanying table shows the regression results

Q8: Exhibit 15-6.Tiffany & Co.has been the world's

Q10: A marketing manager examines the relationship between

Q13: The accompanying table shows the regression results

Q14: Exhibit 15-9.An economist estimates the following model:

Q15: Exhibit 15-5.The accompanying table shows the regression

Q16: Find the 95% confidence interval for the

Q78: Consider the following regression results based on

Q97: The term BLUE stands for Best Linear