Multiple Choice

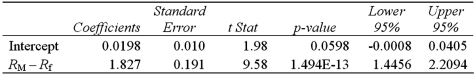

Exhibit 15-6.Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  Refer to Exhibit 15-6.When testing whether the beta coefficient is significantly greater than one,the relevant critical value at the 5% significance level is

Refer to Exhibit 15-6.When testing whether the beta coefficient is significantly greater than one,the relevant critical value at the 5% significance level is  .The conclusion to the test is:

.The conclusion to the test is:

A) Reject H0,and conclude that the return on Tiffany stock is riskier than the return on the market.

B) Do not reject H0,and conclude that the return on Tiffany stock is riskier than the return on the market.

C) Reject H0,and conclude that the return on Tiffany stock is less risky than the return on the market.

D) Do not reject H0,and conclude that the return on Tiffany stock is less risky than the return on the market.

Correct Answer:

Verified

Correct Answer:

Verified

Q59: A crucial assumption in a regression model

Q83: Assume you ran a multiple regression to

Q84: The accompanying table shows the regression results

Q86: Exhibit 15-8.A real estate analyst believes that

Q87: Exhibit 15-7.A manager at a local bank

Q89: Exhibit 15-7.A manager at a local bank

Q91: Refer to the portion of regression results

Q92: In regression, the two types of interval

Q92: Consider the following regression results based on

Q93: A marketing manager examines the relationship between