Essay

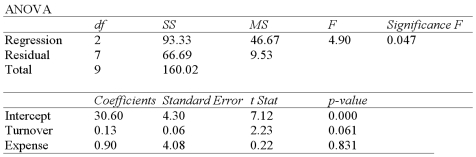

An investment analyst wants to examine the relationship between a mutual fund's return,its turnover rate and its expense ratio.She randomly selects 10 mutual funds and estimates: Return = β0 + β1 Turnover + β2 Expense + ε,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and ε is the random error component.A portion of the regression results is shown in the accompanying table.

Correct Answer:

Verified

a.At the 10% significance level,are the ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Exhibit 15-1.An marketing analyst wants to examine

Q22: Serial correlation occurs when the error term

Q23: In regression,multicollinearity is considered problematic when two

Q24: A simple linear regression,<img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="A simple

Q25: When estimating <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="When estimating

Q27: Exhibit 15-4.A researcher analyzes the factors that

Q28: Consider the following simple linear regression model:

Q29: Exhibit 15-9.An economist estimates the following model:

Q30: The accompanying table shows the regression results

Q31: If in the multiple linear model the