Multiple Choice

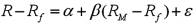

The capital asset pricing model is given by:  ,where

,where  = expected return on the market,

= expected return on the market,  = risk-free market return,and

= risk-free market return,and  = expected return on a stock or portfolio of interest.The response variable in this model is:

= expected return on a stock or portfolio of interest.The response variable in this model is:

A)  .

.

B)  .

.

C)  .

.

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q74: Unlike the coefficient of determination,the coefficient of

Q75: Exhibit 14-10.A sociologist examines the relationship between

Q76: Given the augmented Phillips model: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg"

Q77: Consider the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="Consider

Q78: Consider the sample regression equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg"

Q80: Consider the sample regression equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg"

Q81: A manager at a ski resort in

Q82: The R<sup>2</sup> of a multiple regression of

Q83: Exhibit 14-4.Consider the following sample regression equation

Q117: The value 0.75 of a sample correlation