Essay

An investment analyst wants to examine the relationship between a mutual fund's return,its turnover rate and its expense ratio.She randomly selects 10 mutual funds and estimates: Return =  +

+  Turnover +

Turnover +  Expense +

Expense +  ,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and

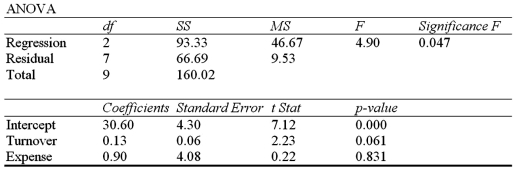

,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and  is the random error component.A portion of the regression results is shown in the accompanying table.

is the random error component.A portion of the regression results is shown in the accompanying table.  a.Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

a.Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

B)Interpret the slope coefficient attached to Expense.

C)Calculate the standard error of the estimate.If the sample mean for Return is 34.7%,what can you infer about the model's predictive power.

D)Calculate and interpret the coefficient of determination.

Correct Answer:

Verified

a.39.75%;

b.If the expense ratio goes up...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.If the expense ratio goes up...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Exhibit 14-3.Consider the following sample regression equation

Q14: Consider the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="Consider

Q15: Exhibit 14-8.An real estate analyst believes that

Q16: Exhibit 14-7.Assume you ran a multiple regression

Q17: Consider the following information regarding a response

Q19: Exhibit 14-6.A manager at a local bank

Q21: In the simple linear regression model,β<sub>0</sub> is

Q22: Exhibit 14-8.An real estate analyst believes that

Q114: Simple linear regression includes more than one

Q125: If two linear regression models have the