Multiple Choice

Consider the expected returns (in percent) from two investment options.Beth wants to determine if investment 1 has a lower variance.Use the following summary statistics to arrive at the results. Investment 1:  = 33.53;n1 = 8

= 33.53;n1 = 8

Investment 2:  = 44.76;n2 = 8

= 44.76;n2 = 8

Identify the relevant null and alternate hypotheses for this test.

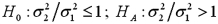

A)

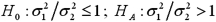

B)

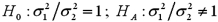

C)

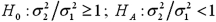

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q71: Exhibit 11-5.Amie Jackson,a manager at Sigma travel

Q72: Compute a 98% confidence interval for the

Q73: Exhibit 11-6.A financial analyst examines the performance

Q74: The following table shows the annual returns

Q77: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="Find and

Q78: Consider the following hypotheses: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="Consider

Q79: A random sample of 10 homes sold

Q80: Exhibit 11-1.Becky owns a diner and is

Q81: Exhibit 11-5.Amie Jackson,a manager at Sigma travel

Q117: Which of the following is a feature