Multiple Choice

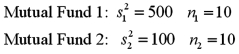

Exhibit 11-6.A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Here are some relevant summary statistics.  Refer to Exhibit 11-6.At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

Refer to Exhibit 11-6.At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

A) No,because the value of the test statistic is less than the critical F value.

B) Yes,because the value of the test statistic is less than the critical F value.

C) Yes,because the value of the test statistic is greater than the critical F value.

D) No,because the value of the test statistic is greater than the critical F value.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A random sample of 18 observations is

Q19: A right-tailed test for the ratio of

Q20: If s<sup>2</sup> is computed from a random

Q21: Which of the following Excel functions is

Q22: A researcher analyzes the returns for two

Q23: Identify the hypothesis that depicts a right-tailed

Q25: Exhibit 11-3.The following are the competing hypotheses

Q26: The result of placing a larger sample

Q28: Exhibit 11-4.Consider the expected returns (in percent)from

Q29: A two-tailed test is used to determine