Essay

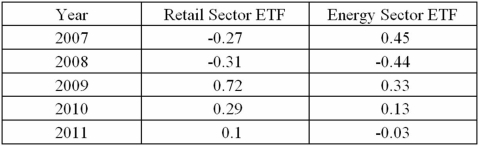

The following is return data for a Retail sector ETF and Energy Sector ETF for the years 2007 through 2011.  a.What is the arithmetic mean return for each ETF?

a.What is the arithmetic mean return for each ETF?

B)What is the geometric mean return for each ETF?

C)What is the sample standard deviation for each ETF? Which ETF was riskier over this time period?

D)Given a risk free rate of 5%.What is the Sharpe Ratio for each ETF? Which investment had a better return per unit of risk over this time period?

Correct Answer:

Verified

a.For Retail ETF,the mean = 10.60%;for E...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Professors at a local university earn an

Q41: The annual returns (in percent)for a sample

Q42: A large city in Southern California collected

Q43: The following is summary measures for Google

Q44: The annual returns (in percent)for a sample

Q47: A luxury apartment complex in South Beach

Q50: The data shows Operating Expenses (In Millions)for

Q51: Amounts spent by a sample of 50

Q94: A box plot is useful when comparing

Q113: The following is a list of average