Essay

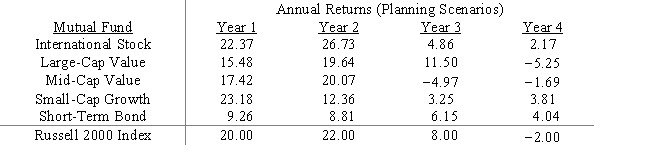

Financial planner Minnie Margin has a substantial number of clients who wish to own a mutual fund portfolio that matches,as a whole,the performance of the Russell 2000 index.Her task is to determine what proportion of the portfolio should be invested in each of the five mutual funds listed below so that the portfolio most closely mimics the performance of the Russell 2000 index.Formulate the appropriate nonlinear program.

Correct Answer:

Verified

IS = proportion of portfolio invested in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Any feasible solution to a blending problem

Q11: The value of the coefficient of imitation,q,in

Q12: The Markowitz mean-variance portfolio model presented in

Q13: A feasible solution is a global optimum

Q14: When components share a storage facility,they are

Q16: The function f (X,Y)= X <sup>2</sup> +

Q17: Nonlinear programming algorithms are more complex than

Q18: Investment manager Max Gaines has several clients

Q19: A nonlinear optimization problem is any optimization

Q20: A feasible solution is a global optimum