Essay

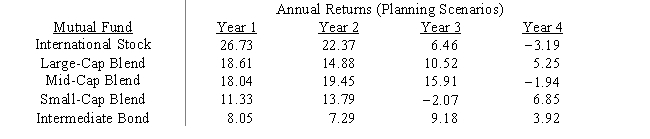

Investment manager Max Gaines wishes to develop a mutual fund portfolio based on the Markowitz portfolio model.He needs to determine the proportion of the portfolio to invest in each of the five mutual funds listed below so that the variance of the portfolio is minimized subject to the constraint that the expected return of the portfolio be at least 4%.Formulate the appropriate nonlinear program.

Correct Answer:

Verified

IS = proportion of portfolio invested in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: In the case of functions with multiple

Q5: When components (or ingredients)in a blending problem

Q6: Financial planner Minnie Margin wishes to develop

Q7: Any feasible solution to a blending problem

Q8: For a typical nonlinear problem,if you change

Q10: Any feasible solution to a blending problem

Q11: The value of the coefficient of imitation,q,in

Q12: The Markowitz mean-variance portfolio model presented in

Q13: A feasible solution is a global optimum

Q14: When components share a storage facility,they are