Accounting Terminology Listed Below Are Nine Technical Accounting Terms Introduced or Emphasized

Essay

Accounting terminology

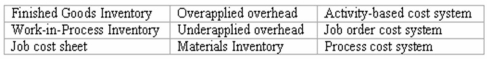

Listed below are nine technical accounting terms introduced or emphasized in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

_____ (a)The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too low.

_____ (b)The account credited as component parts are transferred into production.

_____ (c)A schedule used to accumulate manufacturing costs and to determine the unit costs associated with a specific customer's order.

_____ (d)The inventory account credited when the cost of goods sold is recorded.

_____ (e)The type of cost accounting system most likely used by an oil refinery engaged in the continuous production of petroleum products.

_____ (f)The inventory account debited when manufacturing cost accounts (such as Direct Labor or Materials Inventory)are credited.

_____ (g)The type of cost accounting system likely to be used by a machine shop that manufactures items to the specifications provided by its customers.

Correct Answer:

Verified

(a)Under-applied overhead (b)M...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: An overhead application rate is computed by

Q20: The document that provides information for the

Q25: An activity-based costing system does not help

Q29: Which of the following statements is true

Q40: A collection of job cost sheets would

Q60: The account Work-in-Process Inventory:<br>A)Consists of completed goods

Q68: A debit balance in the Manufacturing Overhead

Q78: A job cost sheet usually contains a

Q84: What are the total manufacturing overhead costs

Q96: Activity-based costing tracks cost to the activities