Essay

Bonds payable-issued between interest dates

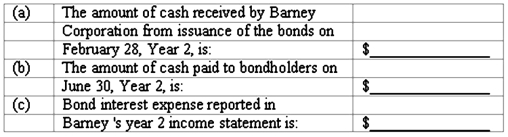

Barney Corporation received authorization on December 31,Year 1,to issue $2,500,000 of 6%,10-year bonds.The interest payment dates are June 30 and December 31.All the bonds were issued at a price of 100,plus accrued interest,on February 28,Year 2,two months after the authorization of the bond issue.  (d)Prepare the journal entry at February 28,Year 2,to record the issuance of the bonds.

(d)Prepare the journal entry at February 28,Year 2,to record the issuance of the bonds.

(e)Prepare the journal entry at June 30,Year 2 to record the first semiannual interest payment on the bonds.

Correct Answer:

Verified

(a)$2,525,000 (b)$75...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: The pension expense of the current period

Q58: Using different accounting methods on financial statements

Q59: On October 1,2015,Master's Co.borrows $500,000 from its

Q59: When an installment note is structured as

Q61: Bonds which may be exchanged for a

Q66: A measure of a company's liquidity is:<br>A)Assets

Q68: The underwriter guarantees the issuing corporation a

Q113: Amortizing a premium on bonds payable:<br>A)Increases interest

Q159: The amounts that a business withholds as

Q166: In estimating annual pension expense,which of the