Essay

Accounting terminology

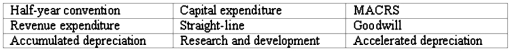

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or Answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or Answer "None" if the statement does not correctly describe any of the terms.

_____ (a.)An expenditure to pay an expense of the current period.

_____ (b.)The accelerated depreciation system used in federal income tax returns for depreciable assets purchased after 1986.

_____ (c.)A policy that fractional-period depreciation on assets acquired or sold during the period should be computed to the nearest month.

_____ (d.)An intangible asset representing the present value of future earnings in excess of normal return on net identifiable assets.

_____ (e.)Expenditures that could lead to the introduction of new products,but which,according to the FASB,should be viewed as an expense of the current accounting period.

_____ (f.)Depreciation methods that take less depreciation in the early years of an asset's useful life,and more depreciation in the later years.

_____ (g.)An account showing the portion of the cost of a plant asset that has been written off to date as depreciation expense.

Correct Answer:

Verified

(a)Revenue expenditure,(b)MACRS,(c)None ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: International standards require that goodwill:<br>A)Be capitalized and

Q18: When a depreciable asset is sold at

Q35: Just as there are depreciation methods to

Q36: Clark Imports sold a depreciable plant asset

Q38: Early in the current year,Tokay Co.purchased the

Q43: An asset which costs $18,800 and has

Q44: Prepare journal entries for the following: <img

Q48: The book value of an asset is

Q53: If a piece of equipment is dropped

Q137: Research and development-financial reporting<br>Alert Industries has spent