Essay

Depreciation and disposal--a comprehensive problem

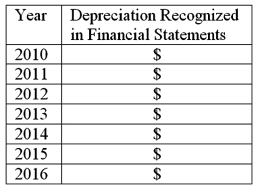

Domino,Inc.uses straight-line depreciation with a half-year convention in its financial statements.On March 10,2010,Domino acquired a computer system at a cost of $98,800.Estimated useful life is six years,with residual value of $5,200.

(a)Complete the following schedule,showing depreciation expense Domino expects to recognize each year in the financial statements.  (b)Assume Domino sells the computer system on October 3,2013,for $26,650.

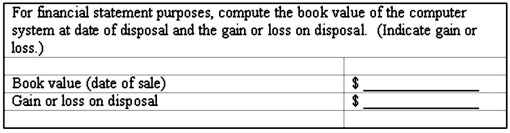

(b)Assume Domino sells the computer system on October 3,2013,for $26,650.

Correct Answer:

Verified

(a)Depreciation Reco...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: An asset which costs $14,400 and has

Q20: For financial reporting purposes,the gain or loss

Q21: The term plant assets refers to long-lived

Q24: Four events pertaining to plant assets are

Q79: Which of the following is a capital

Q91: The adjusting entries to record depreciation or

Q114: The write-down of an impaired asset is

Q133: The systematic write-off of intangible assets to

Q142: Land is purchased for $456,000.Additional costs include

Q145: Most companies benefit by using accelerated depreciation