Multiple Choice

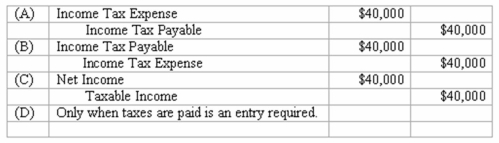

The adjusting entry to recognize income taxes due on a profit of $100,000 and a tax rate of 40% is:

A) A Above.

B) B Above.

C) C Above.

D) D Above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Partner A earns $68,000 from a partnership.Partner

Q10: An S corporation must have a maximum

Q12: Limited personal liability is a characteristic of

Q12: Mutual agency refers to the ability of

Q16: The retained earnings account of Company XYZ

Q17: Retained Earnings represent:<br>A)The profits of the company.<br>B)The

Q18: The journal entry when a dividend is

Q19: The Board of Directors of a corporation:<br>A)Are

Q40: The adjusting entry to record income taxes

Q49: In a sole proprietorship the balance in