Multiple Choice

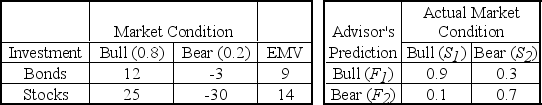

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1) expected profits (in $10,000's) for various market conditions and their probabilities,and (2) the advisor's track record on predicting Bull and Bear markets.  If the advisor predicts a Bull market the EMV of the Bonds alternative,using revised probabilities,is ________.

If the advisor predicts a Bull market the EMV of the Bonds alternative,using revised probabilities,is ________.

A) $85,240

B) $25,710

C) $108,450

D) $75,480

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The expected monetary value without information is

Q21: Frank Forgione has the right to enter

Q39: Ray Crofford is evaluating investment alternatives to

Q43: Consider the following decision table with rewards

Q44: Ray Crofford is evaluating investment alternatives for

Q46: Trey Leeman,Operations Manager at National Consumers,Inc.(NCI),is evaluating

Q63: In a decision analysis problem, variables (such

Q83: A particular electronic component is produced at

Q87: The value of sample information is the

Q92: In a decision-making under risk scenario, the