Multiple Choice

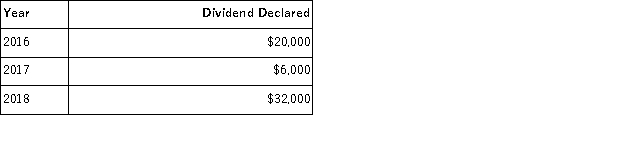

Fargo Company's outstanding stock consists of 400 shares of noncumulative 5% preferred stock with a $10 par value and 3,000 shares of common stock with a $1 par value. During the first three years of operation, the corporation declared and paid the following total cash dividends.  The amount of dividends paid to preferred and common shareholders in 2016 is:

The amount of dividends paid to preferred and common shareholders in 2016 is:

A) $200 preferred; $19,800 common.

B) $4,000 preferred; $16,000 common.

C) $17,000 preferred; $3,000 common.

D) $10,000 preferred; $10,000 common.

E) $20,000 preferred; $0 common.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Preferred stock that the issuing corporation has

Q49: A corporation paid a cash dividend of

Q59: Mayan Company had net income of $132,000.The

Q69: A proxy is a document that gives

Q73: Paid-in capital is the total amount of

Q86: Gershwin Company reported net income of $428,000

Q86: A company has earnings per share net

Q168: The following data were reported by a

Q177: Preferred stock that confers rights to prior

Q179: Prior to June 30,a company has never