Essay

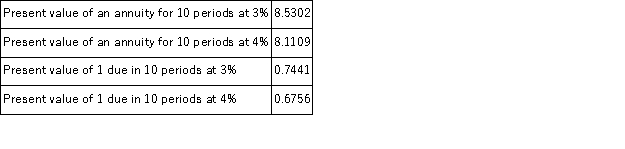

A company issues 6%, 5 year bonds with a par value of $800,000 and semiannual interest payments. On the issue date, the annual market rate of interest is 8%. Compute the issue (selling) price of the bonds. The following information is taken from present value tables:

Correct Answer:

Verified

Correct Answer:

Verified

Q8: A company borrowed cash from the bank

Q9: The issue price of a bond is

Q20: The debt-to-equity ratio enables financial statement users

Q67: A pension plan:<br>A)Is a contractual agreement between

Q74: The legal contract between the issuing corporation

Q103: The carrying (book)value of a bond at

Q174: A particular feature of callable bonds is

Q192: On January 1, Year 1 a company

Q196: The market value (issue price) of a

Q229: The carrying (book) value of a bond