Essay

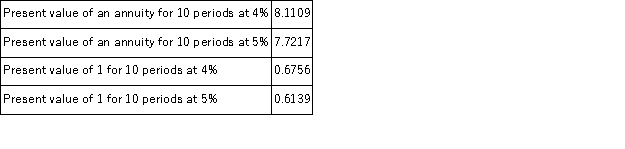

On January 1, a company issues 8%, 5 year, $300,000 bonds that pay interest semiannually each June 30 and December 31. On the issue date, the annual market rate of interest for the bonds is 10%. Compute the price of the bonds on their issue date. The following information is taken from present value tables:

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A 10-year bond issue with a $100,000

Q28: Explain the amortization of a bond discount.

Q30: On January 1, a company borrowed $70,000

Q41: The present value of an annuity can

Q76: Seedly Corporation's most recent balance sheet reports

Q97: A disadvantage of an operating lease is

Q107: An advantage of lease financing is the

Q119: On January 1, a company issues bonds

Q136: A bondholder that owns a $1,000, 10%,

Q158: A disadvantage of bond financing over equity