Essay

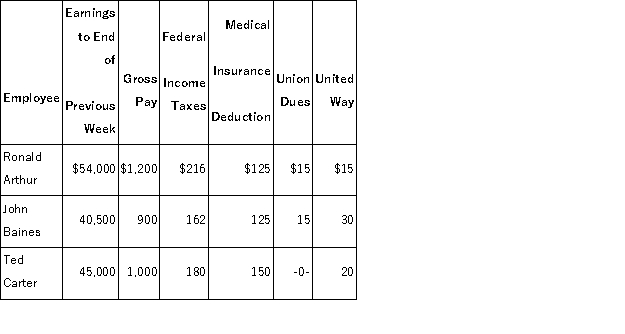

The payroll records of a company provided the following data for the weekly pay period ended December 7:  The FICA social security tax rate is 6.2% on the first $118,500 of earnings each calendar year and the FICA Medicare tax rate is 1.45% on all earnings. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

The FICA social security tax rate is 6.2% on the first $118,500 of earnings each calendar year and the FICA Medicare tax rate is 1.45% on all earnings. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Correct Answer:

Verified

Correct Answer:

Verified

Q67: Classify each of the following items as

Q69: Triston Vale is paid on a monthly

Q72: A table that shows the amount of

Q73: An employee earned $62,500 during the year

Q74: Santa Barbara Express has 4 sales employees,

Q90: On April 12,Hong Company agrees to accept

Q100: Contingent liabilities are recorded or disclosed unless

Q107: An employer's federal unemployment taxes (FUTA) are

Q127: Estimated liabilities commonly arise from all of

Q176: The amount of federal income tax withheld