Essay

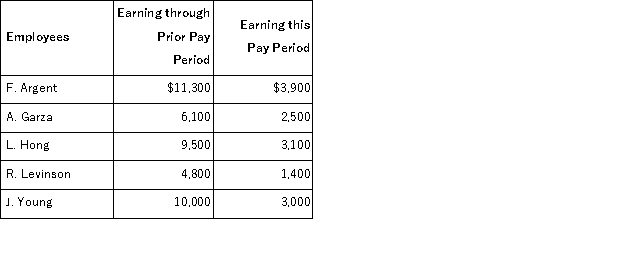

A company's employees had the following earnings records at the close of the current payroll period:  The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $118,500 of earnings plus 1.45% FICA Medicare on all earnings; 0.6% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000. Compute the employer's total payroll taxes expense for the current pay period.

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $118,500 of earnings plus 1.45% FICA Medicare on all earnings; 0.6% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000. Compute the employer's total payroll taxes expense for the current pay period.

Correct Answer:

Verified

1Employee pay subject to unemp...

1Employee pay subject to unemp...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: _are amounts received in advance from

Q41: A company borrowed $60,000 by signing a

Q45: Furniture World is required by law to

Q61: Obligations to be paid within one year

Q66: Drake Company pays its employees for two

Q78: When a company is obligated for sales

Q134: In the accounting records of a defendant,

Q200: A known obligation of an uncertain amount

Q214: A company has 90 employees and a

Q219: Victory Auto Sales, a used car dealership,