Multiple Choice

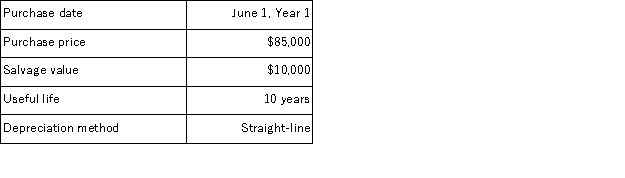

The following information is available on a depreciable asset owned by Mutual Savings Bank:  The asset's book value is $70,000 on June 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

The asset's book value is $70,000 on June 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

A) $8,125.00

B) $7,375.00

C) $4,062.50

D) $3,750.00

E) $7,812.50

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Another name for a capital expenditure is:<br>A)

Q80: The depreciation method in which a plant

Q105: A company's old machine that cost $40,000

Q113: A company purchased land with a building

Q114: On January 1,a company purchased machinery for

Q116: Total depreciation expense over an asset's useful

Q146: _are capital expenditures that make a

Q215: The depreciation method that uses a depreciation

Q231: Anderson Company sold a piece of equipment

Q236: When an asset is purchased (or disposed