Multiple Choice

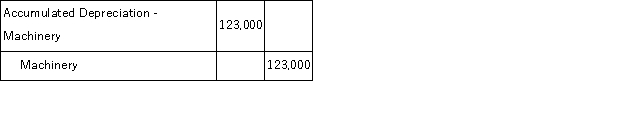

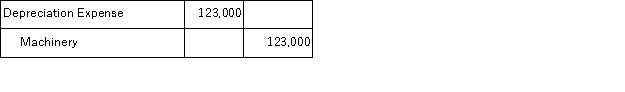

Machinery costing $123,000 with zero salvage value is no longer useful to the company and has no market value. If the machinery has been fully depreciated at the time of disposal, the entry to record the disposal would be:

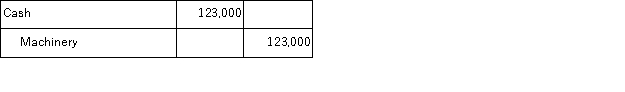

A)

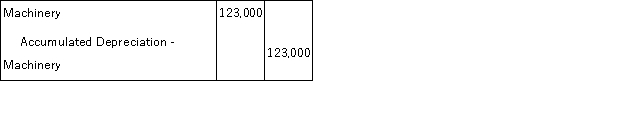

B)

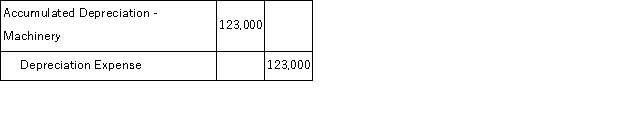

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: A plant asset's useful life is the

Q19: The first step in accounting for an

Q29: Marlow Company purchased a point of sale

Q33: Cliff Company traded in an old truck

Q86: On July 1 of the current year,Timberlake

Q120: Gaston owns equipment that cost $90,500 with

Q129: Salvage value is an estimate of an

Q245: A company purchased land on which to

Q254: On April 1, Year 1, Raines Co.

Q255: Fortune Drilling Company acquires a mineral deposit