Essay

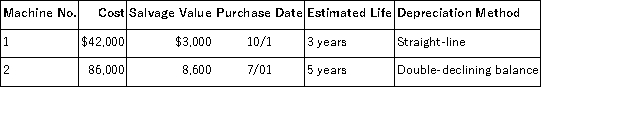

A company's property records revealed the following information about its plant assets:  Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Machine 1:

Year 1 ______________________ Year 2 _______________________

Machine 2:

Year 1 ______________________ Year 2 _______________________

Correct Answer:

Verified

Machine 1:

Year 1: [($42,000 - $3,000)/3...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Year 1: [($42,000 - $3,000)/3...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: On April 1 of the current year,a

Q48: Gain or loss on the disposal of

Q81: Victory Company purchases office equipment at the

Q96: A company purchased and installed machinery on

Q97: The depreciation method that allocates a varying

Q102: A company purchased a weaving machine for

Q103: Equipment with a cost of $103,000 and

Q113: Westport Company reports the following in millions:

Q117: A company had net sales of $1,540,500

Q138: Crestfield leases office space for $7,000 per