Essay

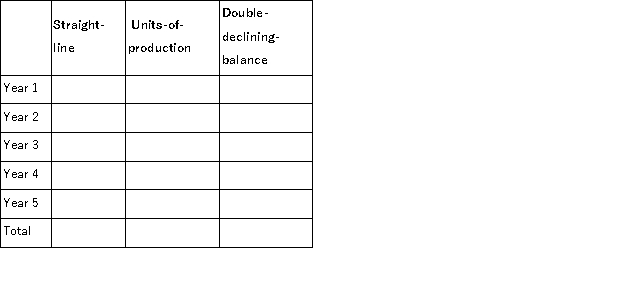

A company purchased a machine on January 1 of the current year for $750,000. Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours, with a salvage value of $75,000) using each of the below-mentioned methods. During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A company purchased a tract of land

Q40: Minor Company installs a machine in its

Q79: Bering Rock acquires a granite quarry at

Q89: The cost of land would not include:<br>A)Purchase

Q122: Depreciation is higher in earlier years and

Q161: A company paid $150,000,plus a 7% commission

Q210: Edmond reported average total assets of $9,965

Q211: A company purchased mining property for $1,837,500

Q211: A company purchased a weaving machine for

Q214: A company purchased equipment on June 28