Multiple Choice

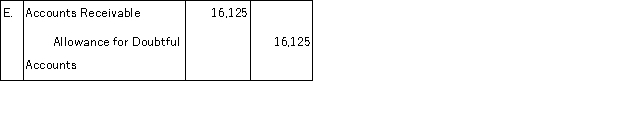

A company ages its accounts receivables to determine its end of period adjustment for bad debts. At the end of the current year, management estimated that $15,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a debit balance of $375. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

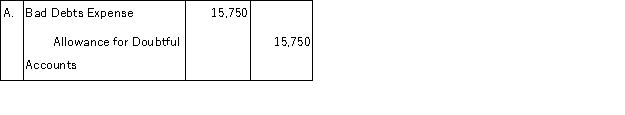

A)

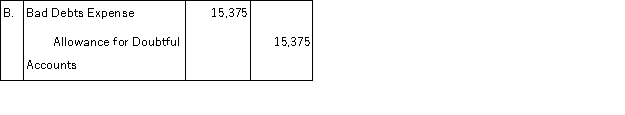

B)

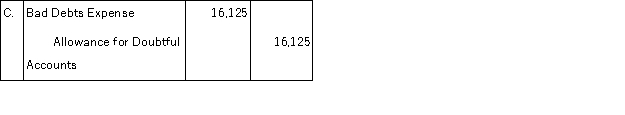

C)

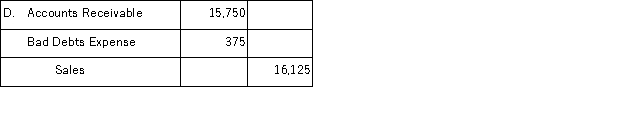

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q19: A company receives a 10%,120-day note for

Q33: Mullis Company sold merchandise on account to

Q34: A Company had net sales of $23,000

Q37: A company reports the following results in

Q37: Brinker accepts all major bank credit cards,including

Q39: Stacey Corp. uses the direct write-off method

Q40: The accounts receivable turnover indicates how often,

Q41: Prepare general journal entries for the following

Q118: Define a note receivable and explain how

Q140: BizCom's customer, Redding, paid off an $8,300