Multiple Choice

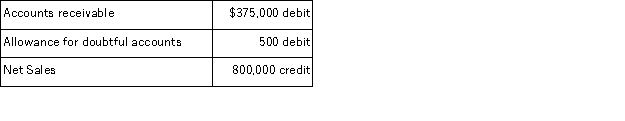

A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit. Based on past experience, the company estimates that 0.6% of credit sales are uncollectible. What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

All sales are made on credit. Based on past experience, the company estimates that 0.6% of credit sales are uncollectible. What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

A) $1,275

B) $1,775

C) $4,500

D) $4,800

E) $5,500

Correct Answer:

Verified

Correct Answer:

Verified

Q7: On July 9,Mifflin Company receives a $8,500,90-day,8%

Q21: _ are amounts owed by customers from

Q57: _ is the charge for using borrowed

Q62: Majesty Productions accepted a $7,200,120-day,6% note from

Q104: Which of the following is an accounting

Q122: If a company holds a large number

Q123: As long as a company accurately records

Q177: A company factored $30,000 of its accounts

Q179: The aging of accounts receivable involves classifying

Q205: The_ method of accounting for bad debts