Multiple Choice

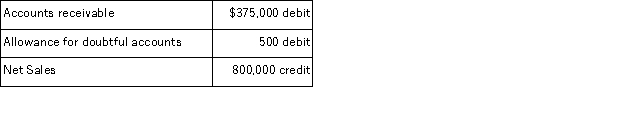

A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit. Based on past experience, the company estimates 0.6% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit. Based on past experience, the company estimates 0.6% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) Debit Bad Debts Expense $2,130; credit Allowance for Doubtful Accounts $2,130.

B) Debit Bad Debts Expense $2,630; credit Allowance for Doubtful Accounts $2,630.

C) Debit Bad Debts Expense $4,300; credit Allowance for Doubtful Accounts $4,300.

D) Debit Bad Debts Expense $4,800; credit Allowance for Doubtful Accounts $4,800.

E) Debit Bad Debts Expense $5,300; credit Allowance for Doubtful Accounts $5,300.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The percent of sales method for estimating

Q69: Giorgio Italian Market bought $4,000 worth of

Q77: Craigmont uses the allowance method to account

Q88: Mullis Company sold merchandise on account to

Q89: On October 17 of the current year,a

Q108: A promissory note received from a customer

Q111: A company borrowed $16,000 by signing a

Q115: A company borrowed $10,000 by signing a

Q117: If a credit card sale is made,

Q118: Mercks accepts the Discovery credit card for