Essay

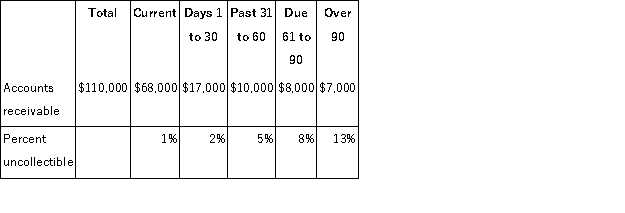

Bonita Company estimates uncollectible accounts using the allowance method at December 31. It prepared the following aging of receivables analysis.  a. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

a. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $550 credit.

c. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $300 debit.

Correct Answer:

Verified

$3,070 -...

$3,070 -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Uniform Supply accepted a $4,800,90-day,10% note from

Q45: The accounts receivable turnover is calculated by

Q48: MacKenzie Company sold $300 of merchandise to

Q70: On September 30, Waldon Co. has $540,250

Q93: Music World sold $7,800 in electronic components

Q95: Uniform Supply accepted a $4,800, 90-day, 10%

Q96: Jones Cement Company has an Accounts Receivable

Q115: Giorgio Italian Market bought $4,000 worth of

Q119: _refers to the expected proceeds from

Q194: Describe the differences in how the direct