Multiple Choice

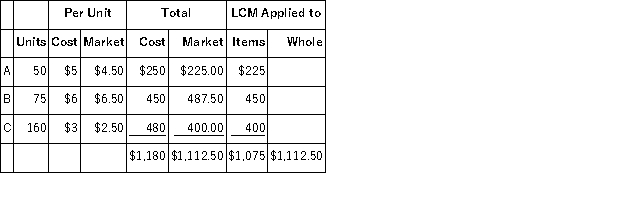

A company has the following per unit original costs and replacement costs for its inventory: Part A: 50 units with a cost of $5 and replacement cost of $4.50.

Part B: 75 units with a cost of $6 and replacement cost of $6.50.

Part C: 160 units with a cost of $3 and replacement cost of $2.50.

Under lower of cost or market, the total value of this company's ending inventory must be reported as:

A) $1,180.00.

B) $1,075.00.

C) $1,112.50 or $1075.00, depending upon whether LCM is applied to individual items or the inventory as a whole.

D) $1,112.50.

E) $1180.00 or $1075.00, depending upon whether LCM is applied to individual items or to the inventory as a wholE.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: An advantage of the weighted average inventory

Q49: Under LIFO, the most recent costs are

Q113: The days' sales in inventory ratio is

Q126: Given the following information, determine the cost

Q128: A company had the following ending inventory

Q129: A corporation has provided the following information

Q130: A company made the following merchandise purchases

Q133: A company made the following merchandise purchases

Q134: Some companies use the _ constraint, also

Q136: A company has inventory of 10 units