Multiple Choice

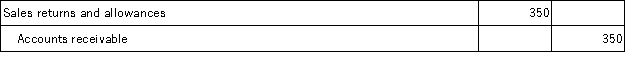

On March 12, Masterson Company, Inc. sold merchandise in the amount of $7,800 to Forsythe Company, with credit terms of 2/10, n/30. The cost of the items sold is $4,500. Masterson uses the gross method of accounting for sales and a perpetual inventory system. On March 15, Forsythe returns some of the merchandise. The selling price of the returned merchandise is $600 and the cost of the merchandise returned is $350. The entry or entries that Masterson must make on March 15 is:

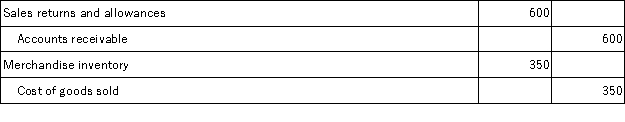

A)

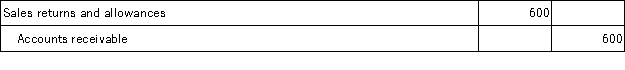

B)

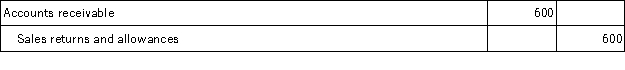

C)

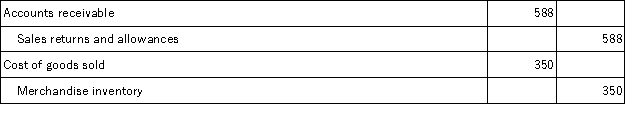

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: What is the acid-test ratio? How does

Q68: A merchandiser:<br>A)Earns net income by buying and

Q79: Describe the recording process (including costs) for

Q107: The current period's ending inventory is:<br>A) The

Q131: The amount recorded for merchandise inventory purchases

Q132: Austin's Pub Supply uses the gross method

Q135: The following information is available for Flanders

Q137: The year-end adjusted trial balance of Gordon

Q219: A _ is an intermediary that buys

Q258: A seller usually prepares a _ to