Multiple Choice

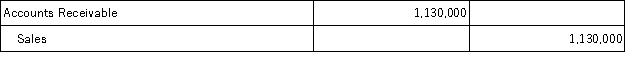

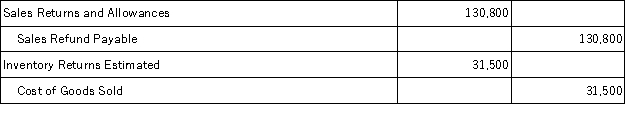

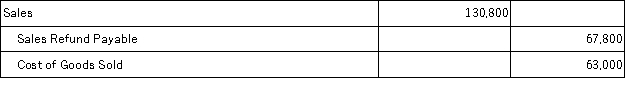

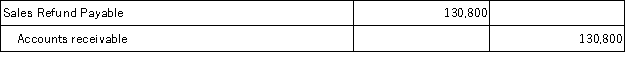

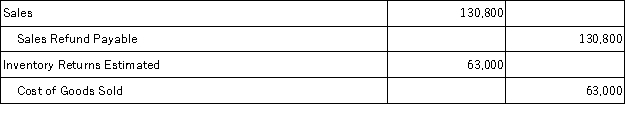

Wellington Company had sales this year of $2,180,000 and cost of goods sold of $1,050,000. Wellington expects returns and allowances in the following year to equal 6% of sales, half being returns of goods and half allowances for merchandise kept by the buyer. The adjusting entry or entries to record the expected sales returns is(are) :

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q58: A company's gross profit was $83,750 and

Q162: All of the following statements related to

Q163: Serene Spa Sales, Inc. uses the gross

Q164: If goods are shipped FOB destination, the

Q168: When using the net method of recording

Q169: On September 12, Vander Company, Inc. sold

Q171: Which of the following accounts is used

Q172: Prepare journal entries to record the following

Q245: FOB _ means ownership of goods transfers

Q248: A company that uses the net method