Multiple Choice

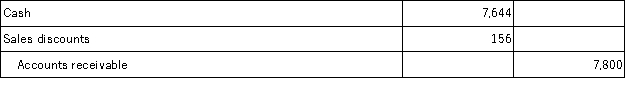

On March 12, Masterson Company, Inc. sold merchandise in the amount of $7,800 to Forsythe Company, with credit terms of 2/10, n/30. The cost of the items sold is $4,500. Masterson uses the gross method of accounting for sales and a perpetual inventory system. On March 15, Forsythe was given an allowance of $600 on defective merchandise that had a cost of $350. Forsythe pays the invoice on March 20, and takes the appropriate discount. The journal entry that Masterson makes on March 20 is:

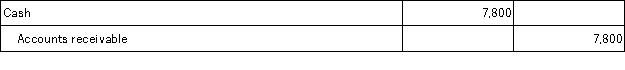

A)

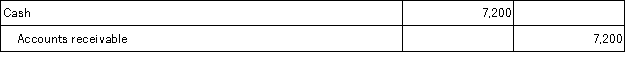

B)

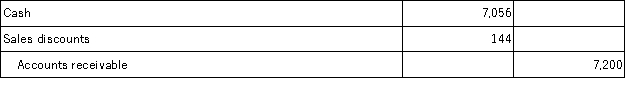

C)

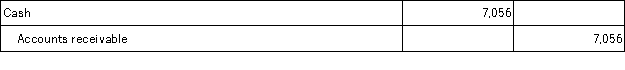

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Sales less sales discounts less sales returns

Q85: On March 12, Klein Company, Inc. sold

Q86: If a buyer of goods that uses

Q89: Describe the recording process (including costs) for

Q91: New revenue recognition rules that apply to

Q92: When a company preparing a multiple-step income

Q95: A company using the gross method of

Q105: A company has net sales of $752,000

Q130: A company had net sales of $752,000

Q157: Sales returns:<br>A) Refer to merchandise that customers