Multiple Choice

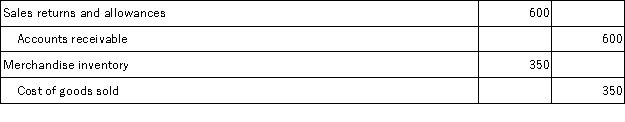

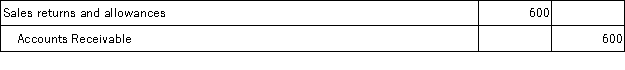

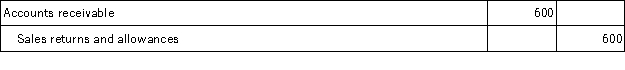

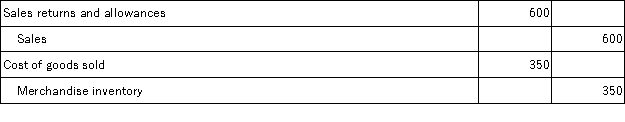

On March 12, Masterson Company, Inc. sold merchandise in the amount of $7,800 to Forsythe Company, with credit terms of 2/10, n/30. The cost of the items sold is $4,500. Masterson uses the gross method of accounting for sales and a perpetual inventory system. On March 15, Forsythe was given an allowance of $600 on defective merchandise that had a cost of $350. Forsythe pays the invoice on March 20, and takes the appropriate discount. The journal entry that Masterson makes on March 15 when the allowance is given is:

A)

B)

C)

D)

E) Sales

Correct Answer:

Verified

Correct Answer:

Verified

Q29: The following statements regarding merchandise inventory are

Q141: A wholesaler is an intermediary that buys

Q238: Vincent Company, Inc. purchased merchandise from Liu

Q239: Borden Corporation had sales this year of

Q240: Kerry Corporation has an unadjusted Accounts Receivable

Q241: In a periodic inventory system, cost of

Q243: Assuming a seller has not yet collected

Q244: Clausen Corporation has estimated for October, based

Q246: The current asset account debited when recording

Q247: Companies that use a perpetual inventory system