Essay

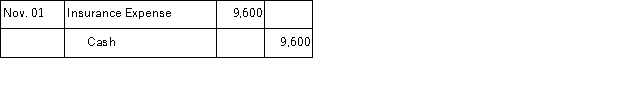

On November 1 of the current year, Salinger Company paid $9,600 cash for a one-year insurance policy that took effect on that day. On the date of the payment, Salinger recorded the following entry:  Prepare the required adjusting entry at December 31 of the current year.

Prepare the required adjusting entry at December 31 of the current year.

Correct Answer:

Verified

($9,600/12 mo. = $8...

($9,600/12 mo. = $8...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: The broad principle that requires expenses to

Q27: The _ depreciation method allocates equal amounts

Q73: Revenue and expense balances are transferred from

Q129: On December 31, the year end, a

Q140: Temporary accounts include all of the following

Q161: If Regent Tax Services' office supplies account

Q223: Classified balance sheets commonly include the following

Q223: Profit margin is defined as:<br>A) Revenues divided

Q224: On October 15, a company received $15,000

Q230: K. Canopy, the stockholder of Canopy Services,