Essay

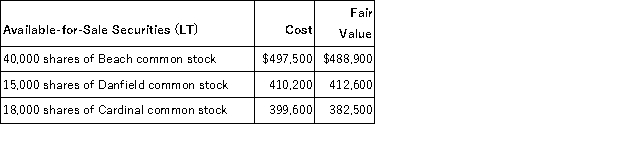

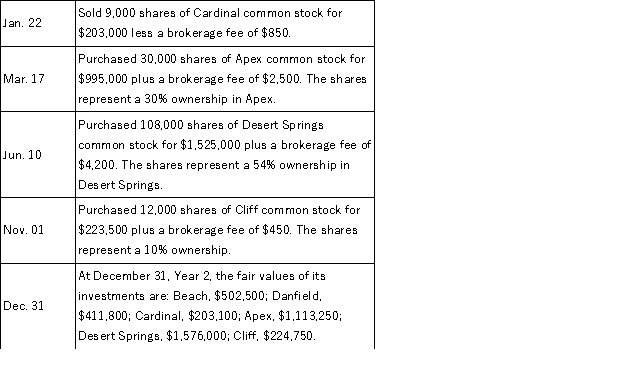

Weston Company had the following long-term available-for-sale securities in its portfolio at December 31, Year 1. Weston had several long-term investment transactions during the next year. After analyzing the effects of each transaction, (1) determine the amount Weston should report on its December 31, Year 1 balance sheet for its long-term investments in available-for-sale securities, (2) determine the amount Weston should report on its December 31, Year 2 balance sheet for its long-term investments in available-for-sale securities, (3) prepare the necessary adjusting entry to record the fair value adjustment at December 31, Year 2.

Correct Answer:

Verified

Year 1: $1,307,300 - $1,284,000 = $23...

Year 1: $1,307,300 - $1,284,000 = $23...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Held-to-maturity securities are equity securities a company

Q8: On January 3, Kostansas Corporation purchased 5,000

Q57: Accounting for long-term investments in equity securities

Q62: Financial statements that show the financial position,results

Q117: All of the following statements regarding accounting

Q152: Consolidated financial statements:<br>A)Show the results of operations,cash

Q167: Roe Corporation owns 2,000 shares of WRJ

Q173: An investor presumed to have significant influence

Q181: When a U.S.company makes a credit sale

Q182: Equity securities reflect a creditor relationship such