Multiple Choice

In May 20X7,a parent entity sold inventory to a subsidiary entity for $30 000.The inventory had previously cost the parent entity $24 000.The entire inventory is still held by the subsidiary at reporting date,30 June 20X7.Ignoring tax effects,the adjustment entry in the consolidation worksheet at reporting date is:

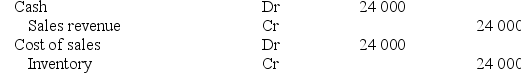

A)

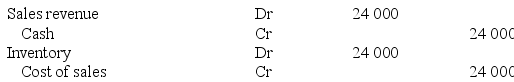

B)

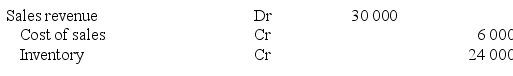

C)

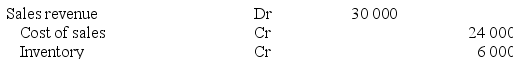

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q11: When an entity sells a non-current asset

Q12: During the year ended 30 June 20X7

Q13: A subsidiary entity sold inventory to a

Q14: Explain the meaning of the term 'unrealised

Q15: A subsidiary entity sold goods to its

Q17: Andronico Limited provided an advance of $500

Q18: A Ltd sold an item of plant

Q19: JoJo Ltd provided an advance of $500

Q20: A parent entity group sold a depreciable

Q21: Explain why there is generally no tax-effect