Multiple Choice

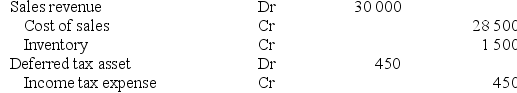

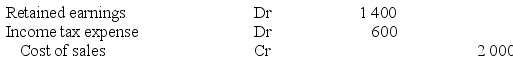

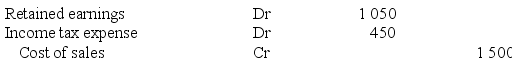

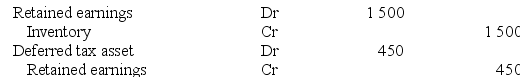

During the year ended 30 June 20X7 a subsidiary entity sold inventory to a parent entity for $30 000.The inventory had previously cost the subsidiary entity $24 000.By 30 June 20X7 the parent entity had sold 75% of the inventory to a party outside the group.The company tax rate is 30%.The adjustment entry in the consolidation worksheet at 30 June 20X8 is:

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A Ltd sold an item of plant

Q2: During the year ended 30 June 20X7,a

Q3: Janus Limited,a subsidiary entity,sold a non-current asset

Q4: If a dividend is paid out of

Q5: A Ltd sold an item of plant

Q7: Discuss the concept of realisation and the

Q8: AASB 10 Consolidated Financial Statements,requires that intragroup

Q9: Explain why consolidation adjustments are necessary in

Q10: A subsidiary entity sold inventory to its

Q11: When an entity sells a non-current asset