Multiple Choice

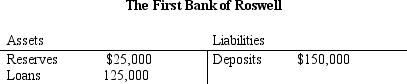

Table 11-4.

-Refer to Table 11-4. If the bank faces a reserve requirement of 10 percent, then the bank

A) is in a position to make a new loan of $10,000.

B) has fewer reserves than are required.

C) has excess reserves of $12,500.

D) None of the above is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: When we say that trade is roundabout

Q8: Economists argue that the move from barter

Q33: People hold $400 million of bank deposits

Q36: The banking system currently has $100 billion

Q67: Which of the following best illustrates the

Q80: Credit cards<br>A)defer payments.<br>B)are a store of value.<br>C)have

Q102: Scenario 11-2.<br>The Monetary Policy of Tazi is

Q280: Liquidity refers to<br>A)the ease with which an

Q316: Table 16-7<br>Metropolis National Bank is currently holding

Q365: If the Fed increases the reserve ratio