Multiple Choice

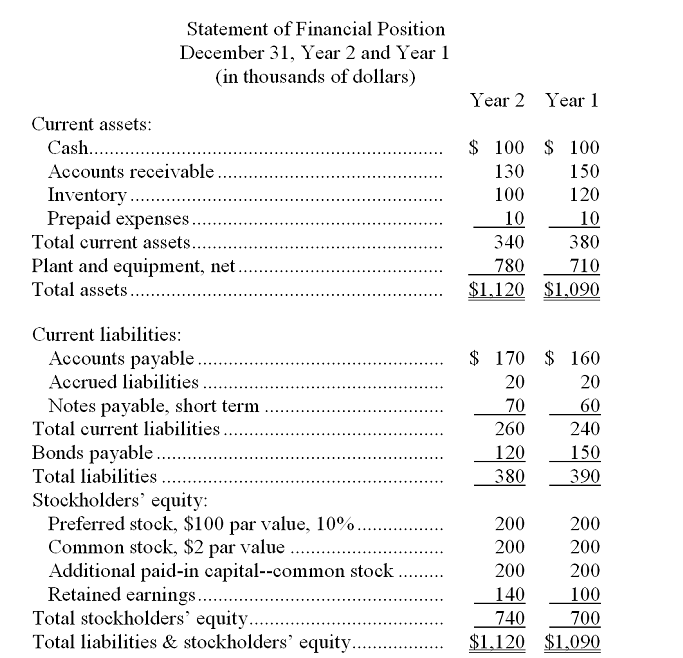

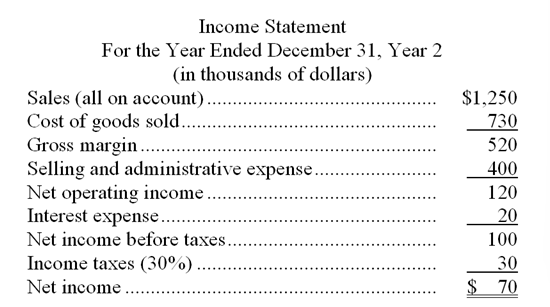

Mccaughey Corporation's most recent balance sheet and income statement appear below:

-The current ratio for CPZ Enterprises is:

A) 1.68

B) 2.14

C) 5.00

D) 5.29

Correct Answer:

Verified

Correct Answer:

Verified

Q155: Lesmerises Corporation's most recent balance sheet and

Q156: Allen Company's average collection period for accounts

Q157: Financial statements for Oram Company appear below:

Q158: Working capital equals current assets, plus noncurrent

Q159: Data from Colinger Corporation's most recent balance

Q161: Selected financial data (in thousands of dollars)

Q162: Wynkoop Corporation has provided the following data:

Q163: The Herald Company has 50,000 shares of

Q164: Lesmerises Corporation's most recent balance sheet and

Q165: Dickey Corporation's most recent income statement appears