Multiple Choice

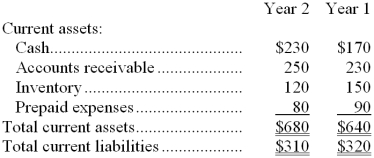

Excerpts from Shelton Corporation's most recent balance sheet appear below:  Sales on account in Year 2 amounted to $1,320 and the cost of goods sold was $890.

Sales on account in Year 2 amounted to $1,320 and the cost of goods sold was $890.

-The inventory turnover for Year 2 is closest to:

A) 6.59

B) 7.42

C) 1.25

D) 0.80

Correct Answer:

Verified

Correct Answer:

Verified

Q136: Lesmerises Corporation's most recent balance sheet and

Q137: Financial statements for Larkins Company appear below:<br><img

Q138: Lesmerises Corporation's most recent balance sheet and

Q139: Craston Company's net income last year was

Q140: Financial statements for Larkins Company appear below:<br><img

Q142: Financial statements for Marcalo Company appear below:

Q143: Olea Corporation has provided the following data:

Q144: Data from Gofman Corporation's most recent balance

Q145: Excerpts from Stys Corporation's most recent balance

Q146: Data from Waisner Corporation's most recent balance