Essay

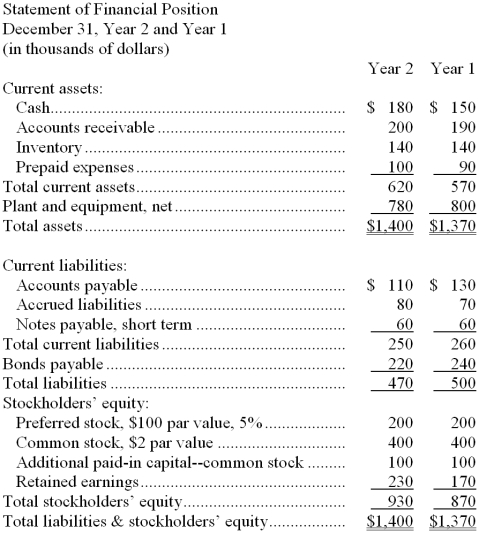

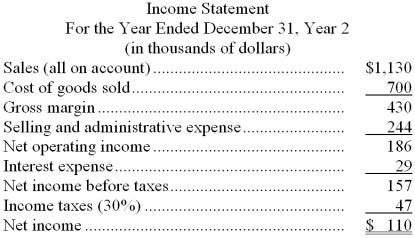

Shull Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $40 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $9.80 per share.

Required:

Compute the following for Year 2:

a. Gross margin percentage.

b. Earnings per share (of common stock).

c. Price-earnings ratio.

d. Dividend payout ratio.

e. Dividend yield ratio.

f. Return on total assets.

g. Return on common stockholders' equity.

h. Book value per share.

i. Working capital.

j. Current ratio.

k. Acid-test ratio.

l. Accounts receivable turnover.

m. Average collection period.

n. Inventory turnover.

o. Average sale period.

p. Times interest earned.

q. Debt-to-equity ratio.

Correct Answer:

Verified

a. Gross margin percentage = Gross margi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Financial statements for Larkins Company appear below:<br><img

Q47: Lesmerises Corporation's most recent balance sheet and

Q48: Dowlen Corporation's most recent balance sheet and

Q49: Harrison Company, a retailer, had cost of

Q50: Juncker Corporation's most recent balance sheet and

Q52: Frawner Company had $140,000 in sales on

Q53: The price-earnings ratio is determined by dividing

Q54: Lesmerises Corporation's most recent balance sheet and

Q55: Iffert Corporation's net income last year was

Q56: Kerson Corporation's most recent balance sheet and