Essay

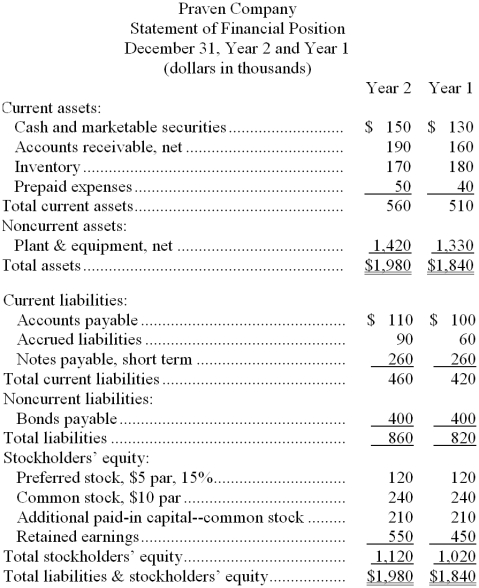

Financial statements for Praven Company appear below:

Dividends during Year 2 totaled $89 thousand, of which $18 thousand were preferred dividends. The market price of a share of common stock on December 31, Year 2 was $130.

Required:

Compute the following for Year 2:

a. Earnings per share of common stock.

b. Price-earnings ratio.

c. Dividend payout ratio.

d. Dividend yield ratio.

e. Return on total assets.

f. Return on common stockholders' equity.

g. Book value per share.

h. Working capital.

i. Current ratio.

j. Acid-test ratio.

k. Accounts receivable turnover.

l. Average collection period.

m. Inventory turnover.

n. Average sale period.

o. Times interest earned.

p. Debt-to-equity ratio.

Correct Answer:

Verified

a. Earnings per share = (Net Income - Pr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Last year Jack Company had a net

Q24: Cintron Corporation's total current assets are $370,000,

Q25: The acid-test ratio is a test of

Q26: The gross margin percentage is computed taking

Q27: Financial statements for Oram Company appear below:

Q29: Lesmerises Corporation's most recent balance sheet and

Q30: Arston Company's net income last year was

Q31: Financial statements for Larkins Company appear below:<br><img

Q32: Which of the following is true regarding

Q33: Excerpts from Deandrade Corporation's most recent balance