Essay

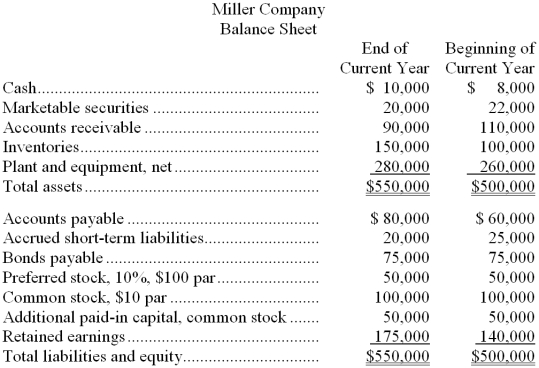

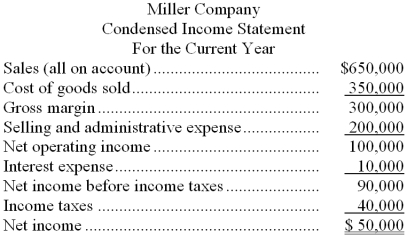

Condensed financial statements of Miller Company at the beginning and at the end of the current year are given below:

The company paid total dividends of $15,000 during the year, of which $5,000 were to preferred stockholders. The market price of a share of common stock at the end of the year was $30.

Required:

On the basis of the information given above, fill in the blanks with the appropriate figures.

Example: The current ratio at the end of the current year would be computed by dividing $270,000 by $100,000

a. The acid-test ratio at the end of the current year would be computed by dividing _______________ by _________________.

b. The inventory turnover for the year would be computed by dividing _______________ by _________________.

c. The debt-to-equity ratio at the end of the current year would be computed by dividing _______________ by _________________.

d. The earnings per share of common stock would be computed by dividing _______________ by _________________.

e. The accounts receivable turnover for the year would be computed by dividing _______________ by _________________.

f. The times interest earned for the year would be computed by dividing _______________ by _________________.

g. The return on common stockholders' equity for the year would be computed by dividing _______________ by _________________.

h. The dividend yield would be computed by dividing _______________ by _________________.

Correct Answer:

Verified

a. $120,000; $100,000

b. $350,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. $350,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q57: Data from Shamp Corporation's most recent balance

Q58: Excerpts from Deandrade Corporation's most recent balance

Q59: Information concerning the common stock of Morris

Q60: Odegaard Corporation's net income last year was

Q61: Dadisman Corporation's most recent balance sheet and

Q63: Naser Corporation's total current assets are $390,000,

Q64: Financial statements for Marcalo Company appear below:

Q65: Financial statements for Larkins Company appear below:<br><img

Q66: The following data have been taken from

Q67: Financial statements for Marcalo Company appear below: