Multiple Choice

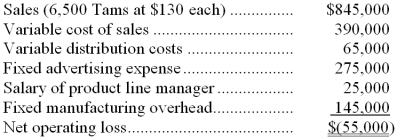

The Clemson Company reported the following results last year for the manufacture and sale of one of its products known as a Tam.  Clemson Company is trying to determine whether or not to discontinue the manufacture and sale of Tams. The operating results reported above for last year are expected to continue in the foreseeable future if the product is not dropped. The fixed manufacturing overhead represents the costs of production facilities and equipment that the Tam product shares with other products produced by Clemson. If the Tax product were dropped, there would be no change in the fixed manufacturing costs of the company.

Clemson Company is trying to determine whether or not to discontinue the manufacture and sale of Tams. The operating results reported above for last year are expected to continue in the foreseeable future if the product is not dropped. The fixed manufacturing overhead represents the costs of production facilities and equipment that the Tam product shares with other products produced by Clemson. If the Tax product were dropped, there would be no change in the fixed manufacturing costs of the company.

-Assume that discontinuing the manufacture and sale of Tams will have no effect on the sale of other product lines. If the company discontinues the Tam product line, the change in annual operating income (or loss) should be:

A) $55,000 decrease

B) $65,000 decrease

C) $90,000 decrease

D) $70,000 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Closter Corporation makes three products that use

Q9: One of the dangers of allocating common

Q10: Kleffman Corporation is presently making part X31

Q11: The management of Dorl Corporation has been

Q12: Vanikoro Corporation currently has two divisions which

Q14: The management of Drummer Corporation is considering

Q15: The management of Zorrilla Corporation is considering

Q16: A customer has asked Clougherty Corporation to

Q18: Libbee Corporation is presently making part I50

Q50: Which of the following costs are always